We all are familiar with stamp paper engraved on all our legal documents, however, not many of us are aware of their significance in making a piece of paper a legal document. Rental agreements are very common, especially in big cities like Chandigarh, Mohali, and Zirakpur, where people migrate for job opportunities and other purposes. If you are also puzzled about Which Stamp Paper Is Required For Rent Agreement? worry not and read this blog by Gupta Document Center. The blog covers all the details about stamp papers in detail and informs readers about their need for rental agreements, the varying values of stamp papers, and their significance in drafting rental agreements.

Stamp paper can be simply defined as a special type of paper majorly used in framing legal documents. The primary purpose of a stamp paper is to provide authenticity and legality to all legal agreements and contracts. This comprehensive blog by the Gupta Document Center will answer, Which Stamp Paper Is Required For a rental agreement, what is its purpose, and how to purchase the stamp paper for the rental agreement.

Gupta Document Center is an all-time destination to get all your legal work done in time. To get information about rent agreement services in Chandigarh reach us at +91-7888700485, or drop an email at Guptadocumentcentre183@gmail.com.

Need for Stamp Paper in Rental Agreements

Stamp papers comprise pre-printed revenue or tax stamps on it. The stamp paper indicates a specific amount of stamp duty or a type of tax paid to the government. Rental agreements are a legal contract between the tenant and homeowner. Using stamp paper on rental agreements enforces its authenticity and validity.

The law also mandates that a certain amount shall be paid to the Central/State Govt. each time specific kinds of transactions take place. The need for stamp papers in the rental agreement can be briefed below:

- Gives legal validity and authenticity to the rental agreement.

- A legal requirement in many jurisdictions

- Helps prevent fraud and backdated agreements.

Different Ways to Pay Stamp Duty

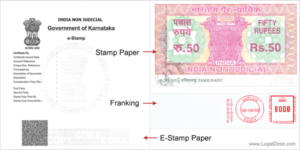

Earlier the stamp duty could only be paid through stamp papers that were supposed to be purchased by the homeowner. However, with the new advancements and updates in the legal system, the government has made many different ways to pay the stamp duty. Most of these updates save you time and make it more efficient to get the legal work done. The newly introduced ways of paying the stamp duty are mentioned below:

- With a franking machine

- Through e-Stamping

- Adhesive stamps, paying at the registrar’s office, etc.

- Papers bearing impressed Stamps which would be the non-judicial Stamp paper

However, you should know that these listed methods are not available in all the states. Some states accept all the methods while others have their own acceptable ways.

Stamp Paper Required for Rent Agreement

By, now we all know that no document becomes legal unless you get it executed on stamp paper. Due to the varied range of stamp papers, people often get confused about which stamp paper is required for the rent agreement. A stamp paper for a rent agreement usually costs INR 100. Mostly in India 100 rupees stamp paper is used in the rental agreements. The minimum value of a stamp paper is INR 50 and it can go as high as INR 1000.

Some states in India do not accept a 100 Rs. stamp paper for rental agreements. The stamp value is valid only for the rent agreement which is not registered. For the registered rental agreement, you are required to pay the stamp duty as per the rent and tenure.

The value of stamp papers for rental agreements is mentioned in the table below:

| STATE | AMOUNT | AGREEMENT PERIOD |

| Chandigarh | – 1.5% of the total rent paid/payable

– 3% of the total rent paid/payable – 6% of the total rent paid/payable |

– 5 or less than 5 years

– 10 or less than 10 years – More than 10 years |

| Karnataka | 1.0 % of the total rent + INR 500 or deposit paid annually | Up to 11 months |

| Delhi | 2.0% | Up to 5 years |

| Gurgaon | 1.5% of the average annual rent | Up to 5 years |

| Gurgaon | 3.0% of the average annual rent | 5 to 10 years |

| Maharashtra | 0.25% of the total rent | Up to 60 months |

| Uttar Pradesh | 4.0% of annual rent + deposit | Less than a year |

E-Stamp Papers for Rental Agreements

Purchasing physical stamp papers is a time-consuming process as finding a licensed Stamp vendor can take a lot of time and effort. Some stamp paper vendors do not keep stamp papers of all denominations. People who choose to approach non-licensed Stamp vendors are put at risk of purchasing fake stamp papers. E-Stamping is the initiative of the Indian government to tackle the problem of counterfeit stamp papers.

The states that allow E-Stamping are Assam, Gujarat, Himachal Pradesh, Karnataka, Maharashtra, Delhi-NCR, Tamil Nadu, Uttarakhand and Uttar Pradesh. To get your rental agreement printed on an e-stamp paper, you are required to purchase the e-stamp paper from allotted centers in your city. The key benefits of using E-Stamp papers for your rental agreements are briefed below:

- E-Stamp papers can be easily purchased online or through authorized vendors.

- Available 24/7 and allows you to start the process at your convenience.

- Reduces the need for paperwork, physical storage, and maintenance.

- Highly cost-effective and save money being spent on traveling to stamp vendors or government offices.

- Offers valid and secure payment options.

Notarize your Rental Agreement for Validity

Notarizing any legal document means getting it verified by a notary public, who is legally authorized and an impartial official. The validity of a legal document becomes 100% if it is notarized. However, it is up to the involved parties whether or not they want to get their rental agreement notarized. The notarized rent agreement is valid up to 11 months only. In case the tenure period is more than 11 months, it should be registered. There are some legal documents that do not require to be notarized. The notary may also verify that the appropriate stamp duty has been paid on the stamp paper, as required by the relevant laws and regulations.

Conclusion

The blog on Which Stamp Paper Is Required For Rent Agreement, elaborates everything related to different stamp papers and their value in different states of India. The advent of E-Stamping will revolutionize the way legal documents are approached. Therefore, everyone should become familiar with e-stamp papers and other advanced ways of paying the stamp duty.